Amendments to India's Competition Law : Implications for M&A

The Competition (Amendment) Act, 2023 (the “Amendment Act”) has recently been published in Official Gazette for general information. It should be noted that the Amendment has not yet come into force. These amendments will come into force on a notified date published by the government in gazette. Moreover, the government can notify the provisions in a phased manner instead of implementing the entire amendments in one go. Additionally, certain amendments that require clarification through regulations by the CCI, such as the deal value threshold, will only be enforced after the publication of such regulations.

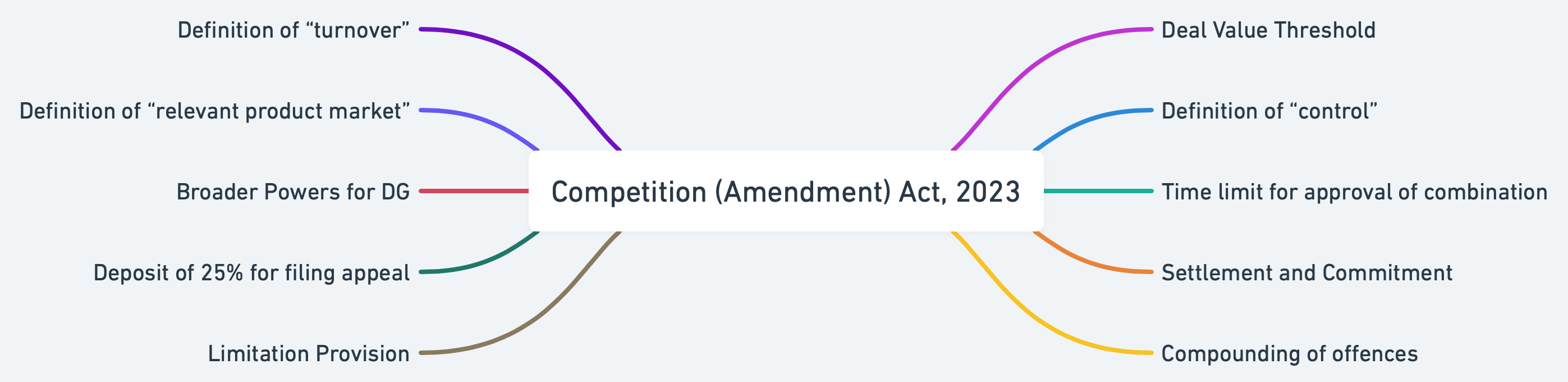

This article aims to provide insights into the significant modifications made by the Amendment to the Competition Act, 2002 (the ”Act”).

Overview of key changes introduced through Amendment Act

| Competition Act, 2002 | Amendments introduced through Competition(Amendment)Act,2023 | |||

|---|---|---|---|---|

| Deal value threshold for combination | The Act prohibits any person or enterprise from entering into a combination (acquisition, merger or amalgamation) which may cause an appreciable adverse effect on competition. This prohibition applies to transactions above a certain threshold of assets and turnover of the parties. | The Amendment Act expands the definition of combination to include transactions with a value above Rs 2,000 crore. | ||

| Definition of control in respect of combination | The Act defines control as control over the affairs or management by one or more enterprises or groups over another enterprise or group. | The Amendment Act modifies the definition of control as the ability to exercise material influence over the management or affairs or strategic commercial decisions by one or more enterprises or groups over another enterprise or group. | ||

| Time limit for approval of combination | The Act specifies that any combination shall not come into effect until the CCI has approved the combination or 210 days have passed from the day of filing of notice of proposed combination with CCI, whichever is earlier. | The Amendment Act reduces the period of 210 days to 150 days. Further, the amendment provides that CCI has to make prima facie opinion on effect of combination on competition within 30 days of filing of notice with CCI. | ||

| Anti-competitive agreements | The Act prohibits anti-competitive agreements (agreements which can cause an appreciable adverse effect on competition within India). Certain agreements between enterprises or persons engaged in identical or similar trade are presumed to have an appreciable adverse effect on competition. | The Amendment Act provides that even those enterprises or persons who are not engaged in identical or similar trade shall be presumed to be part of anti-competitive agreements, if they participate in the furtherance of such agreements. | ||

| Settlement and Commitment in anti-competitive agreements and abuse of dominant position | Under the Act, CCI may initiate proceedings against enterprises on various grounds including entering into anti-competitive agreements, abuse of dominant position, etc. | The Amendment Act permits CCI to close inquiry proceedings in respect of anti-competitive agreement or abuse of dominant position if the enterprise offers: (i) settlement (may involve payment), or (ii) commitments (may be structural or behavioural in nature). The manner and implementation of settlement and commitment may be specified by CCI through regulations. | ||

| Definition of Relevant product market | The Act defines relevant product market as products and services which are considered interchangeable or substitutable by the consumer. | The Amendment Act widens the definition of relevant product market to include the production or supply of products and services considered inter-changeable or substitutable by the supplier. | ||

| Compounding of offences | The Act do not have any provision for compounding of offences. | The Amendment Act provides compounding of certain offences (excluding offences punishable with imprisonment). | ||

| Quantum of penalty for anti-competitive agreements or abuse of dominant position | The Act provides penalty of upto ten (10) per cent of average turnover of last three financial years. | The Amendment Act added an explanation to expand the scope of turnover by including global turnover derived from all products and services by a person or enterprise. | ||

| Broader Powers for Director General | The Act empowers the Director General (DG) to conduct dawn raids on instructions from the CCI, subject to securing a warrant from the Chief Metropolitan Magistrate, Delhi. However, powers of the DG during search and seizure were not codified. | The Amendment Act codified the powers of DG and even broadened them by empowering the DG to examine even legal advisors on oath. This provision prima facie appears to be in violation of attorney client privilege. |

The deal value threshold for combination:

Post amendment, a notice about proposed combination (acquisition, merger or amalgamation) to the CCI would be mandatory if

- the value of the transaction exceeds INR 20 billion, and

- the target enterprise (which is being acquired, taken control of, merged or amalgamated) has “substantial business operations in India”.

The parties cannot use the de minimis exemption if they breach the deal value threshold. However, it is not clear if the transaction value would include the global transaction value or India-specific transaction value.

The definition of ‘control’:

The CCI has interpreted ‘control’ to include material influence. The Amendment Act merely gives statutory recognition to the interpretation. The Amendment Act defines ‘control’ the definition of control as the ability to exercise material influence over the management or affairs or strategic commercial decisions by one or more enterprises or groups over another enterprise or group.

The term ‘material influence’ is still unexplained.

Time limit for approval

The Act specifies that any combination shall not come into effect until the CCI has approved the combination or 210 days have passed from the day of filing of notice of proposed combination with CCI, whichever is earlier.

The Amendment Act reduces the period of 210 days to 150 days. Further, the amendment provides that CCI has to make prima facie opinion on effect of combination on competition within 30 days of filing of notice with CCI.

Definition of relevant product market

The existing definition of “relevant product market” only includes products or services that are regarded as interchangeable or substitutable by the consumers. The Amendment Act has expanded the existing definition which now also includes all products or services that suppliers consider interchangeable or substitutable.

Settlements and Commitments

Another significant change is the introduction of provisions allowing parties to offer settlements and voluntarily undertake certain commitments. The CCI can now close inquiry proceedings (proceedings arising out of anti-competitive agreement or abuse of dominant position) before issuing a final decision if the enterprise offers

- settlement (may involve payment), or

- commitments (may be structural or behavioural in nature).

However, it is not obligatory for the CCI to accept settlement offer. A decision on offer has to be taken after duly considering the nature, gravity and impact of the contraventions. The manner and implementation of settlement and commitment has to be specified by the CCI through regulations.

Penalty on the basis of global turnover

The Amendment Act also changes the basis for calculating penalties for anti-competitive activities from “relevant turnover” to “global turnover,” resulting in higher penalties for global multi-product companies.

Broader Powers to the Director General

The Amendment Act codified the powers of DG and even broadened them by empowering the DG to examine even legal advisors on oath. The DG’s investigation powers have also been extended, allowing them to seek and retain information and documents for up to 360 days. This provision prima facie appears to be in violation of attorney client privilege under the Evidence Act.

Deposit

To file an appeal against a CCI order, the appellant must deposit twenty five (25) per cent of the amount in terms of the CCI’s order.

Limitation

The Amendment Act introduces a limitation period of three years to file a complaint with the CCI, but the CCI can condone delays if there are valid reasons. The CCI can also reject any complaint based on similar facts and issues addressed in a previous order.

Concluding Remarks

To conclude, the Amendments to the Competition Act represent a positive move towards establishing a stronger regulatory framework for competition. The increased powers granted to the CCI are likely to result in more rigorous enforcement, which will require businesses in India to be more vigilant and proactive in their compliance efforts to avoid potential legal ramifications.

•Laws are constantly changing, either

their substance or their interpretation. Even though every attempt is made to keep the information correct

and updated, yet if you find some information to be wrong or dated, kindly let us know. We will acknowledge

your contribution.Click here to know more.

•Disclaimer: This is not professional advice. Please read Terms of Use (more specifically clauses 3 and 4) for detailed disclaimer.